Protect Your Money with

Confirmation of Payee

Protecting Your Payments with Confidence

The Payments Industry are introducing a new safety feature called Confirmation of Payee to help ensure your money goes to the right account. This extra layer of protection checks that the BSB and account number match the intended recipient.

Now rolling out across online banking platforms, it's one more way we're helping keep your payments safe.

What is Confirmation of Payee?

Confirmation of Payee is a new, industry-wide security feature designed to help protect your money.

Before a payment is made, it checks that the account name, BSB, and account number you’ve entered match the details held by the recipient’s bank—then shows you the result.

It’s an extra step for peace of mind when sending money.

How does Confirmation of Payee Work?

Confirmation of Payee is a security feature designed to prevent payment errors and protect against fraud.

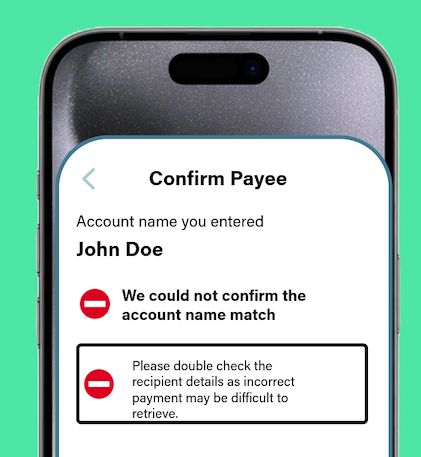

When you enter a recipient’s account details—including their name, BSB, and account number—the system automatically verifies this information with the receiving bank. You’ll then see a clear result indicating whether the details match their records.

Based on this verification result, you have full control over your next steps. You can proceed with confidence if everything matches, take a moment to double-check the details if there’s a discrepancy, or cancel the transaction entirely if something seems wrong. This simple verification process gives you greater assurance that your money will reach its intended destination safely.

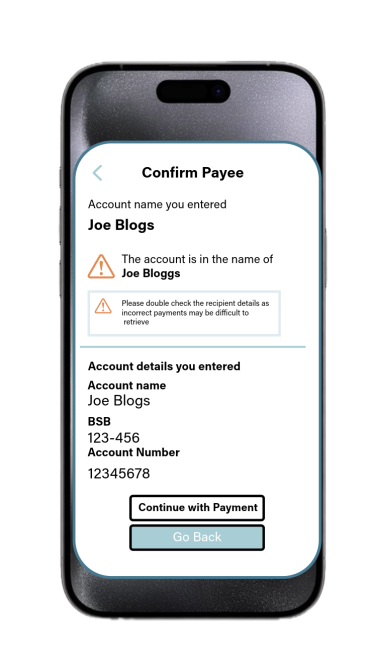

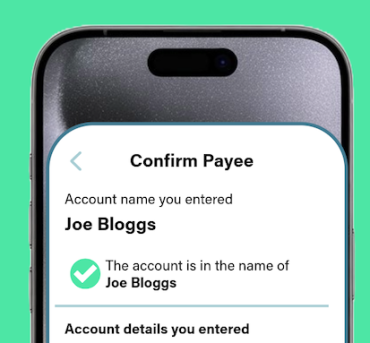

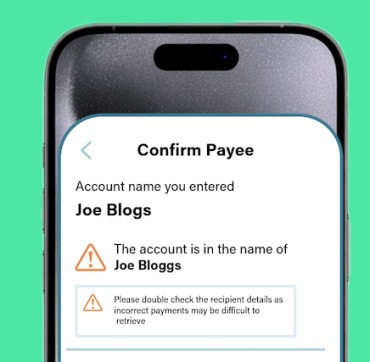

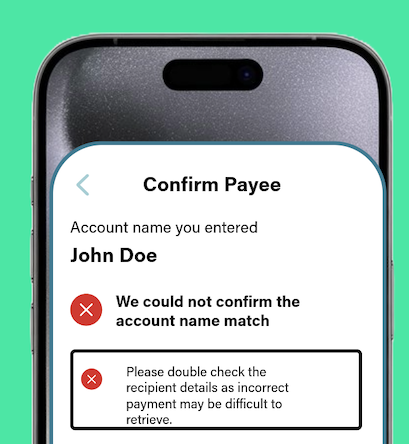

Understanding Your Match Results

The verification results provide crucial guidance for your payment decision. When the system shows a mismatch or unclear result, it's worth taking a moment to double-check the account details with your intended recipient before completing the transaction. If anything appears suspicious or incorrect, you have the option to stop the payment entirely, helping protect your funds from potential errors or fraudulent activity.

Close match means the details you’ve entered closely match the bank records of the intended recipient.

No match means that the details you entered do not match the bank records of the intended recipient.

The service could not confirm the account details you entered match.

Match means the details you’ve entered match the bank records of the intended recipient.

Protecting Yourself from Scams

Trust your instincts—if something feels suspicious, it probably is. Remember that Confirmation of Payee is a verification system that works silently in the background and operates only through your bank’s payment process. The service will never reach out to you independently, request money transfers, or ask for your personal banking information. Any emails, texts, or calls claiming to represent Confirmation of Payee are fraudulent attempts to steal your information.

If you suspect you’ve encountered a scam or fallen victim to fraudulent activity, contact your bank or financial institution immediately for assistance.

FAQs

What happens if the account details don't match?

If there’s a mismatch, you’ll receive a clear notification before completing your payment. You can then verify the correct details with the recipient, update the information if needed, or choose to cancel the transaction entirely. The system is designed to give you this information so you can make an informed decision about whether to proceed.

Will Confirmation of Payee delay my payments?

No, the verification process happens instantly in the background as you enter the payment details. There’s no additional waiting time, and your payments will be processed at the same speed as usual. The check simply provides you with match information before you authorise the transaction.

Is my personal information shared with other banks during the verification process?

The system only shares the minimum information necessary to verify the account details—typically just the account name, BSB, and account number you’ve entered. Your personal banking information and transaction history remain private and secure with your own financial institution.

What should I do if I keep getting mismatches for details I know are correct?

If you’re confident the details are accurate but continue receiving mismatch notifications, contact your bank for assistance. There may be minor variations in how names are recorded (such as nicknames vs. full names) or other technical issues that customer service can help resolve.

Does Confirmation of Payee work for all types of payments and all banks?

Confirmation of Payee coverage varies depending on your bank and the recipient’s bank. The service is gradually being implemented across financial institutions, so some payments may not have verification available yet. Your bank can provide specific information about which transactions and recipients are currently covered by the service.